Shortcuts

Title Page

hPIN/hTAN: A Lightweight and Low-Cost e-Banking Solution against Untrusted ComputersShujun Li1, Ahmad-Reza Sadeghi2,3, Sören Heisrath3, Roland Schmitz4 and Junaid Jameel Ahmad1

1 University of Konstanz, Germany

2 Darmstadt University of Technology and Fraunhofer SIT, Germany

3 Ruhr-University of Bochum, Germany

4 Stuttgart Media University, Germany

This paper has been published in Financial Cryptography and Data Security: 15th International Conference, FC 2011, Gros Islet, St. Lucia, February 28 - March 4, 2011, Revised Selected Papers, Lecture Notes in Computer Science, vol. 7035, pp. 235-249, Springer-Verlag GmbH, 2012. © IFCA

Abstract

In this paper, we propose hPIN/hTAN, a low-cost hardware token based PIN/TAN system for protecting e-banking systems against the strong threat model where the adversary has full control over the user's computer. This threat model covers various kinds of attacks related to untrusted terminal computers, such as keyloggers/screenloggers, session hijackers, Trojan horses and transaction generators. The core of hPIN/hTAN is a secure and easy user-computer-token interface. The security is guaranteed by the user-computer-token interface and two underlying security protocols for user/server/transaction authentication. The hPIN/hTAN system is designed as an open framework so that the underlying authentication protocols can be easily reconfigured. To minimize the costs and maximize usability, we chose two security protocols dependent on simple cryptography (a cryptographic hash function and a random number generator). In contrast to other existing hardware-based solutions, hPIN/hTAN depends on neither a second trusted channel nor a secure keypad nor external trusted center. Our prototype implementation does not involve cryptography beyond a cryptographic hash function. The minimalistic design not only enhances usability but also increases security since more complicated systems tend to have more security holes and software bugs. As an important feature, hPIN/hTAN exploits the human user's active involvement in the whole process to compensate security weaknesses caused by careless human behavior.Links

- Paper (Full Edition, error corrected): http://www.hooklee.com/Papers/FC2011_Full.pdf

- Paper published in FC2011 proceedings (error corrected): http://www.hooklee.com/Papers/FC2011.pdf

- Presentation @ FC2011

- Citation Information (BibTEX): to be added

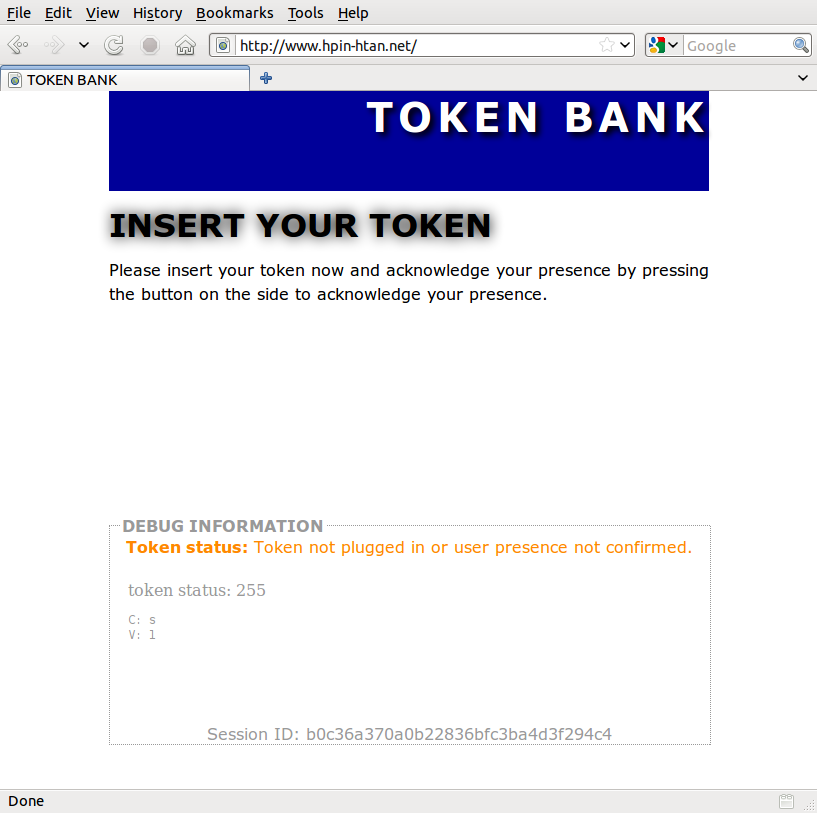

- A virtual e-banking website demonstrating our proof-of-concept system: http://www.hPIN-hTAN.net

hPIN/hTAN in a Nutshell

- Simplistic design + Open framework

- Two parts: hPIN for login + hTAN for transaction

- Three h-s: hardware (USB token) + hashing + human

- Three no-s: no trusted keypad + no trusted OOB (out-of-band) channel + no encryption

- Four security requirements: PIN confidentiality, user authenticity, server authenticity, transaction integrity/authenticity

-

A better balance between security and usability

A better balance between security and usability

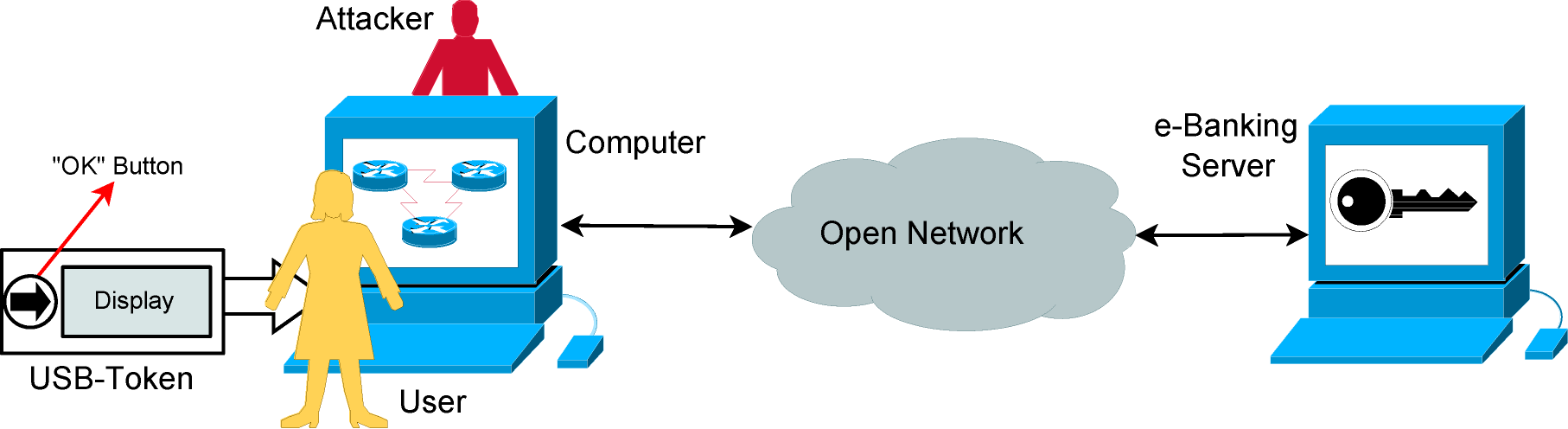

Threat Model and System Requirements

- USB-token = a processing unit + memory units (for program and data) + a communication (USB) module + an "OK" button + a trusted display

- Data @ USB-token: (UID, s, CT, KT* = KT ⊕ h(PIN || s), PIN* = HMAC(KT, PIN || s))

- Data @ Server: (UID, h(KT), CS)

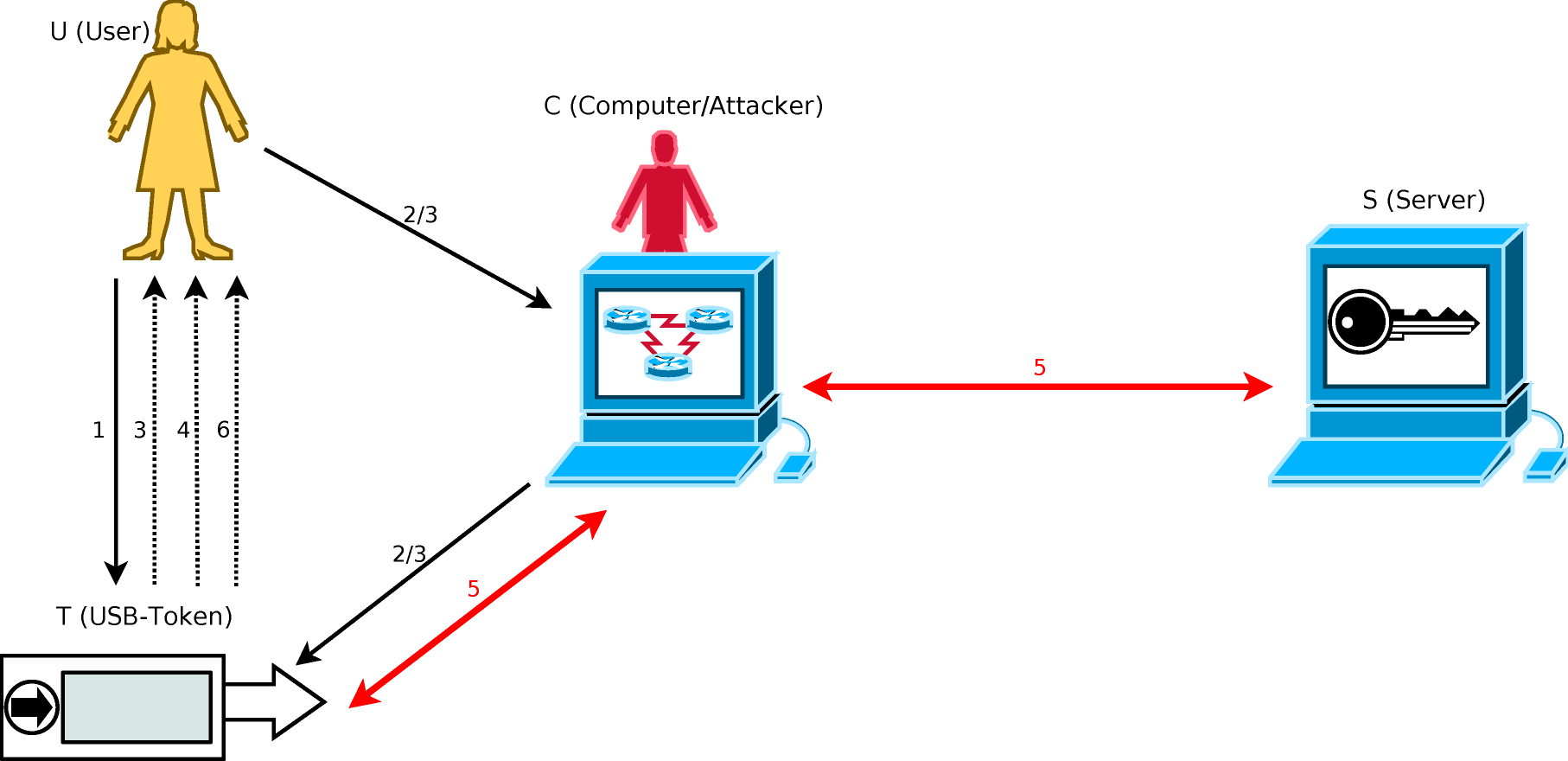

hPIN

- Step 1: U connects T to C, and presses the “OK” button on T.

- Step 2: U enters IDU on the untrusted keyboard and sends it to T via C.

- Step 3: For i=1, …, n, T and U perform the following interactive protocol to enter PIN.

- Step 4: T verifies if PIN* = HMAC(KT* ⊕ h(PIN || s), PIN || s). If so, then T recovers the secret key as KT = KT* ⊕ h(PIN || s), stores h(KT) in its volatile memory for future use in the hTAN part, shows a "PIN correct" message to the user U via its display, and goes to Step 5; otherwise T performs CT++, shows an alert to U and stops. If CT > VT, T locks itself. Here, VT is a parameter controlling the security against random guess attack of the PIN.

-

Step 5: T and S authenticate each other by following a mutual authentication protocol. When the SKID3 protocol is used, the mutual authentication process works as follows:

S -> T: (rS, H1 = HMAC(h(KT), rS || rT || S)),

T -> S: H2 = HMAC(h(KT), rT || rS || T),

- Step 6: T shows a message on its display to inform U about the result of the mutual authentication protocol in Step 5.

Legend: Dashed lines denote information display, and bold lines should the reconfigurable part.

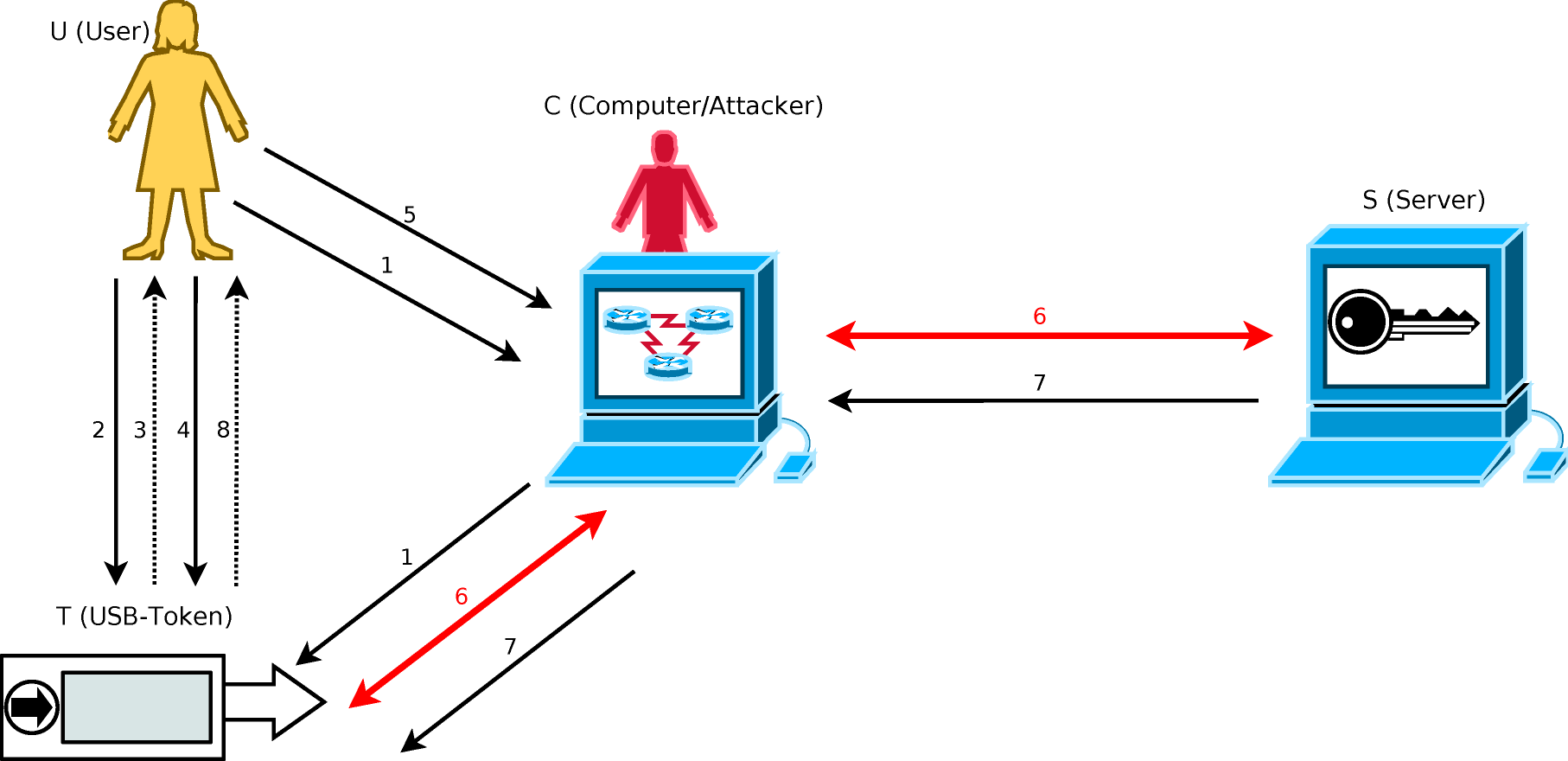

hTAN

-

Step 1: U clicks a button on the e-banking web page to inform T about the start of a new online transaction. Then, she inputs each sensitive transaction data (STD) item one after another on the untrusted keyboard of C by repeating Steps 1-4.

To embed STD verification into the input process, each character in the STD is shown as an asterisk "*" on the untrusted monitor of C, but in clear on the trusted display of T. This can naturally force U to verify the STD simultaneously while she is entering the STD. If U presses

key, T shows an eye-catching warning message to inform the user for a few seconds and then the previously entered character is deleted. - Step 2: Upon completion of current STD item, U presses the "OK" button on T.

- Step 3: T highlights current STD item for a few seconds, and prompts U to press the "OK" button again if the current STD item was not changed by C after Step 2.

- Step 4: U presses the "OK" button again to approve the current STD item.

- Step 5: U inputs non-sensitive transaction data (NSTD) to T by filling a blank on the web page in clear.

- Step 6: T sends STD and NSTD to S by running a transaction/message authentication protocol. Here, we use HMAC to build the following protocol:

S -> T: (rS, H3 = HMAC(h(KT); rS || rT || STD)),

T -> S: (IDU, H4 = HMAC(h(KT); rT || rS || STD)),

where rT and rS are two new nonces generated by T and S, respectively.

- Step 7: S checks if H4 = HMAC(h(KT); rT || rS || STD). If so, S executes the requested transaction and sets M = "success", otherwise sets M = "error". Then, S sends H5 = HMAC(h(KT); rS || rT || M || STD) to T.

- Step 8: T checks if H5 = HMAC(h(KT); rS || rT || "success" || STD). If so, it shows "transaction executed", otherwise "transaction failed", on its display.

Proof-of-Concept System

User study

- Number of test persons: 20 (students and staff members of the University of Konstanz and the Stuttgart Media University)

- Median login time (PIN = 8327): 27.5 seconds

- Login success rate: 60/66 = 91%

- Median time for making a transaction with 55 characters: 70 seconds (1.27 seconds per character)

- User's average opinion on the overall usability: 3.65 (moderately usable - very usable)

- User's median opinion on the overall usability: 4 (very usable)

How lightweight is the token?

-

Hardware

- Microcontroller: ATmega32 @ 16 MHz

- Program memory (Flash): 32 KB

- Program memory (EEPROM): 1 KB

- Data memory (RAM): 2 KB

-

Software

- Size of firmware ≈ 10 KB (can be downsized to 5-6 KB)

- Number of lines of C code ≈ 1500 (own code) + 1100 (other’s code for LCD and the SHA-1 hash function)

How low-cost is the token?

-

Our actual costs: 3-5 € per token

- Microcontroller: 1 €

- Display: 1-3 €

- Case: < 1 €

- Other hardware stuff: ≤ 1 €

- Programmer (Sören Heisrath): 0 €

-

Actual costs of mass production: ≤ 5 € per token?

- Batch purchase is always much cheaper!

- Programming costs per token is negligible: 3 man months / O(100,000) << 1 €.

- The gap between the token vendor and bank customers…

hPIN/hTAN vs. Existing Solutions

- e-banking CAPTCHAs: insecure against automated attacks [Li et al., Breaking e-Banking CAPTCHAs, ACSAC 2010]

- iTAN (indexed TAN): insecure against MitM (Man-in-the-Middle) attacks

- mTAN (mobile TAN): insecure against mobile malware; require a trusted OOB channel; unavoidable additional costs (SMSs); untrusted telecommunication service provider (click here to see a recent news report)

- photoTAN: insecure against mobile malware

- sm@rtTAN plus: not very portable (with trusted keypad); repeated data input; expensive; require banking card

- sm@rtTAN optic: not very portable (with trusted keypad); require optical sensors; expensive; require banking card

- AXSionics personal token: require optical sensors; expensive (including fingerprint recognition system); dependency on third-party website

- Class-4 e-banking smart card readers like FINREAD/FinTS/HBCI: not very portable (with trusted keypad); expensive; require banking card

- IBM ZTIC: without PIN entry protection; complicated design (encryption + TLS/SSL + HTTPS)

- ...

- hPIN/hTAN: portable (without trusted keypad); independent (no dependency on an OOB channel or a trusted third-part website other than the e-banking server); dedicated but cheap device (simplistic design); no risk of mobile malware; no smart card needed; no optical component needed; enhanced user experience of security; open framework that can be further generalized/complicated if necessary

Errata

In the published edition of the paper, the SKID3 protocol in Step 5 of hPIN protocol is erroneous, which was caused by a mistake when we made some changes to the description of hPIN protocol. In addition, in both hPIN and hTAN protocols, the key used in HMAC should be h(KT), not KT. This is a typo we made in the paper writing. We apologize for making these errors.To be more exact, in hPIN protocol, the following part

T -> S: UID,

S -> T: rT,

T -> S: (UID, rS, H1 = HMAC(KT, rS || rT || T)),

S -> T: H2 = HMAC(KT, rT || rS || S)

should read

T -> S: (UID, rT),

S -> T: (rS, H1 = HMAC(h(KT), rS || rT || S)),

T -> S: H2 = HMAC(h(KT), rT || rS || T)

And in the hTAN protocol, KT should be replaced by h(KT) wherever it appears.

Yet another error is about PIN* which is represented by two different equations: h(PIN || KT || s) and HMAC(KT, PIN || s). Since the latter is more general, so it should be used to replace the former.